The US has started gas supplies to the European market, which analysts believe cannot pose a threat to traditional suppliers like Russia and Norway. The first tanker with American LNG arrived in Europe in late April. According to an article in Die Welt, “The shipment of LNG from the US to Portugal could accelerate the drop of gas prices in Europe,” Sputnik reported.

The US has started gas supplies to the European market, which analysts believe cannot pose a threat to traditional suppliers like Russia and Norway. The first tanker with American LNG arrived in Europe in late April. According to an article in Die Welt, “The shipment of LNG from the US to Portugal could accelerate the drop of gas prices in Europe,” Sputnik reported.

However, the current situation is that Russia’s Gazprom continues to supply large amounts of gas to Europe, the report said. In the first quarter of 2016, the Russian company increased its supplies to Europe by 28%. But the question is still open regarding how much gas the US will be able to supply to Europe.

“Even if the US focuses all its export capacities on Europe, without supplies to other regions, exports in Europe will reach only 24 billion cubic meters. It would only cover 5% of Europe’s annual consumption that has reached 426 billion cubic meters,” it said.

Analysts are not sure whether the US will increase deliveries to Europe, but maintain that LNG exports to Asia would be more profitable for US companies.

In an interview with Bloomberg, Statoil senior vice president for marketing and trading, Tor Martin Anfinnsen, said LNG shipment by the US will not squeeze pipeline-transported gas from the European market.

The price of US-produced gas is expected to rise in 2016, which will increase export costs to Europe.

According to RBC Capital Markets, the price of gas at Henry Hub (the largest gas distribution point in the US) would rise by 32% in 2017.

“All European gas pipelines can compete with US deliveries. Even if there are long-term gas contracts between the US and European countries, they would pose no threat to traditional pipeline suppliers,” Anfinnsen said.

“Pipelines will be the main gas supply routes to Europe,” he added.

Oil & Gas

The Norwegian Petroleum Directorate (NPD) has issued an update on its analysis of recoverable oil from Norway’s various offshore fields and discoveries. NPD’s goal in 2005 was to achieve growth in oil reserves of 5 BBbl over 10 years. The actual result is somewhat below that figure, although the target would have been achieved if Statoil’s development plan for Johan Sverdrup in the North Sea had been submitted before the end of 2014.“There has been substantial resource growth in many fields,” said Kirsti Veggeland, assistant director general for shelf analysis. “The most important reasons for this are more wells, extended field lifetimes and improved knowledge.”

The Norwegian Petroleum Directorate (NPD) has issued an update on its analysis of recoverable oil from Norway’s various offshore fields and discoveries. NPD’s goal in 2005 was to achieve growth in oil reserves of 5 BBbl over 10 years. The actual result is somewhat below that figure, although the target would have been achieved if Statoil’s development plan for Johan Sverdrup in the North Sea had been submitted before the end of 2014.“There has been substantial resource growth in many fields,” said Kirsti Veggeland, assistant director general for shelf analysis. “The most important reasons for this are more wells, extended field lifetimes and improved knowledge.”

In addition, NPD reviewed 62 discoveries for which development decisions had not been taken in 2005. Since then, 28 have been developed and their oil reserves, due to a combination of new information, improved reservoir understanding and optimization of development solutions and drainage strategies.

Discoveries made after 2004 also led to development decisions for 13 new fields, and these have contributed 80 MMcm to reserves growth, with Edvard Grieg, Ivar Aasen, and Knarr, accounting for over 75% of that figure.

NPD had hoped that improved recovery measures would lead to stronger growth in oil volumes, Veggeland added. “However, many new opportunities to improve recovery have been identified, and the potential is greater in 2015 than it was 10 years ago.”

(offshore-mag)

Most smuggled IS oil goes to Turkey, sold at low prices: Norwegian report

A newly-leaked report on illegal oil sales by Islamic State (IS), which was ordered to be compiled by Norway, has revealed that most of the IS-smuggled oil has been destined for Turkey, where it is sold off at bargain low prices. Norwegian daily Klassekampen leaked details of the report, which was put together by Rystad Energy, an independent oil and gas consulting firm, at the request of the Norwegian Foreign Ministry.“Large amounts of oil have been smuggled across the border to Turkey from IS-controlled areas in Syria and Iraq,” Klassekampen cited the report as saying. “[The] oil is sent by tankers via smuggling routes across the border [and] is sold at greatly reduced prices, from $25 to $45 a barrel.”

A newly-leaked report on illegal oil sales by Islamic State (IS), which was ordered to be compiled by Norway, has revealed that most of the IS-smuggled oil has been destined for Turkey, where it is sold off at bargain low prices. Norwegian daily Klassekampen leaked details of the report, which was put together by Rystad Energy, an independent oil and gas consulting firm, at the request of the Norwegian Foreign Ministry.“Large amounts of oil have been smuggled across the border to Turkey from IS-controlled areas in Syria and Iraq,” Klassekampen cited the report as saying. “[The] oil is sent by tankers via smuggling routes across the border [and] is sold at greatly reduced prices, from $25 to $45 a barrel.”

The crude is reportedly sold on the black market at greatly reduced prices, while the Brent benchmark is currently trading at $35-$50 per barrel.

To compile the report, which is dated from July, Rystad Energy used its own database as well as sources in the region.

“Exports happen in a well-established black market via Turkey,” the report concluded. “Many of the smugglers and corrupt border guards, who helped Saddam Hussein avoid international sanctions, are now helping IS export oil and import cash.”

In the beginning of December, the Russian Defense Ministry had released evidence which it said shows most of the illegal oil trade by IS going to Turkey.

Russia has earlier said it is aware of three main oil smuggling routes to Turkey, and Deputy Defense Minister Anatoly Antonov presented video evidence of operations, as well as detailed maps, at a briefing for journalists.

Ankara has denied the allegations. Erdogan said that nobody had a right to “slander” Turkey by accusing it of buying oil from Islamic State. Erdogan even claimed that he will resign if such accusations were proven to be true. Moreover, the US has defended Turkey, denying any ties between Ankara and IS.

The NPD reported Wednesday that the current recoverable oil on the Norwegian Continental Shelf exceeds the estimated figure for 2005. A select number of producing fields and 62 discoveries, for which development decisions had not been made in 2005, were reviewed in order to determine the latest figures.

The NPD reported Wednesday that the current recoverable oil on the Norwegian Continental Shelf exceeds the estimated figure for 2005. A select number of producing fields and 62 discoveries, for which development decisions had not been made in 2005, were reviewed in order to determine the latest figures.

Over the course of the ten year period, 28 of these discoveries were developed and their oil reserves have nearly doubled. The NPD has attributed this to new information, better reservoir understanding and optimization of development solutions and drainage strategies.

Discoveries made after 2004 also led to development decisions for 13 new fields, according to the NPD, which have contributed an overall resource growth totalling 2.8 billion standard cubic feet of oil. The Edvard Grieg, Ivar Aasen and Knarr fields account for more than 75 percent of this volume.

The NPD’s latest review was a way to track the agency’s goal from 2005, which was to achieve an oil reserve growth of 28 billion cubic feet, or five billion barrels, over ten years. Although the reserve growth turned out to be significantly less, the goal would have been reached if the development plan for Johan Sverdrup had been submitted before the end of 2014, instead of February 2015.

Assistant Director General for shelf analysis in the NPD Kirsti Veggeland commented in a statement from the government agency:

“A lot of good work has been done to increase the resources on the Norwegian shelf, and there has been substantial resource growth in many fields. The most important reasons for this are more wells, extended field lifetimes and improved knowledge. Decisions were also made to develop new deposits in the fields over the ten-year period.

“The NPD had hoped that improved recovery measures would account for a greater share of the growth in oil reserves. However, many new opportunities to improve recovery have been identified, and the potential is greater in 2015 than it was ten years ago.”

The NPD’s review follows Wood Mackenzie’s report last August, which stated that Norway has 10 billion barrels of oil equivalent of discovered hydrocarbons that are yet to be developed. Oil industry analysts at the research firm indicated that the reserves could potentially add $106 billion dollars to Norway’s oil and gas industry revenues.

(rigzone)

DNO ASA, the Norwegian oil and gas operator, announced Thursday a new daily record of 170,000 barrels of oil produced from the Tawke field in the Kurdistan region of Iraq, of which 30,000 barrels were sold into the local market and the balance allocated for export. Tawke production in the first quarter of 2015 was 104,925 barrels of oil per day (bopd), of which 8,679 bopd was sold into the local market.

DNO ASA, the Norwegian oil and gas operator, announced Thursday a new daily record of 170,000 barrels of oil produced from the Tawke field in the Kurdistan region of Iraq, of which 30,000 barrels were sold into the local market and the balance allocated for export. Tawke production in the first quarter of 2015 was 104,925 barrels of oil per day (bopd), of which 8,679 bopd was sold into the local market.

In the current quarter to date, production has averaged 146,309 bopd, including 26,027 bopd sold into the local market.

The company’s realized prices for local sales currently average around USD 40 per barrel, with payments received upfront and revenues split 50/50 with the Kurdistan Regional Government.

“We are ramping up production, export and local sales following the recently completed Tawke capacity expansion,” said Bijan Mossavar-Rahmani, DNO’s Executive Chairman. “We will dust off investment plans as our revenue stream continues to grow,” he added.

In early May, DNO completed a two-year investment program doubling Tawke wellhead, processing and pipeline capacity to 200,000 bopd with the addition of ten horizontal wells, two production trains and a 44-kilometer, 24-inch pipeline.

DNO will hold its Annual General Meeting in Oslo Thursday at 10:00 AM CET at the Thon Hotel Vika Atrium.

Daily Times file photo

ConocoPhillips has announced it will suspend San Juan Basin drilling.

The Myanmar Government has awarded a contract to Statoil and Conoco Phillips to explore an offshore block for oil and gas off the Rakhine coast. Statoil is a Norwegian company which operates in 36 countries while Conoco Phillips is based in Houston, Texas and operates in over 27 countries.

The companies’ Singapore based subsidiaries will be responsible for the exploration and an environmental impact assessment will be conducted first. According to the Kyemon newspaper the companies will invest over $323 millions dollars to explore the block and production sharing agreements would span eight years.

World’s Longest Subsea Cable Between Norway and Britain Awaits Final Decision

Norwegian grid operator Statnett is expected to make a final investment decision in the first quarter on a 1.5-2 billion euro project for what would be the world’s longest subsea cable. The power inter connector to Britain aims to secure power supplies in both countries. According to Statnett’s website, the project will provide benefits to both sides. When there are higher winds Norway will be able to import power from the British at a lower price than in the Norwegian market and conserve the water in its many hydropower reservoirs.Britain, respectively, will have the opportunity to buy cheaper hydropower from Norway when it needs.

Norwegian grid operator Statnett is expected to make a final investment decision in the first quarter on a 1.5-2 billion euro project for what would be the world’s longest subsea cable. The power inter connector to Britain aims to secure power supplies in both countries. According to Statnett’s website, the project will provide benefits to both sides. When there are higher winds Norway will be able to import power from the British at a lower price than in the Norwegian market and conserve the water in its many hydropower reservoirs.Britain, respectively, will have the opportunity to buy cheaper hydropower from Norway when it needs.

The state-owned Statnett has already received governmental approval for the project in October 2014. The 700-km long cable across the North Sea should be ready by 2020 after the final investment decision is coordinated with the British National Grid, Reuters reported citing a statement from Statnett.

Norway will remain a stable gas supplier to Europe for many years to come, Norwegian Prime Minister Erna Solberg said Wednesday. The announcement was made at a press briefing after her meeting with President of the European Council Donald Tusk in Brussels, Belgium. “We have discussed interdependence on energy security in Europe. And I would like to underline that Norway is and will continue to be a stable and reliable gas supplier to the EU for many years to come,” Solberg told journalists.According to Solberg, it is important for Norway to be involved in discussing energy security in Europe as it might help reach transparency in all decisions related to the energy sector.

Norway will remain a stable gas supplier to Europe for many years to come, Norwegian Prime Minister Erna Solberg said Wednesday. The announcement was made at a press briefing after her meeting with President of the European Council Donald Tusk in Brussels, Belgium. “We have discussed interdependence on energy security in Europe. And I would like to underline that Norway is and will continue to be a stable and reliable gas supplier to the EU for many years to come,” Solberg told journalists.According to Solberg, it is important for Norway to be involved in discussing energy security in Europe as it might help reach transparency in all decisions related to the energy sector.

The news came amid the efforts of the European Council to reduce Europe’s dependence on Russian gas and clarify expectations by Europe that Norway will remain a consistent fuel supplier.

In March 2014, the export of Norwegian gas to Europe set a record, when Gassco, a Norwegian gas transport system operator, reported a 10 percent increase in export to Belgium, France and Germany. The gas export to EU at the time was measured to be a total of 233 million cubic meters per day. Norway’s share in gas exports to Europe is expected to increase in the coming years, according to media reports.

(Nadarajah Sethurupan)

Several oil and gas projects to be developed in Norway in the next two years could be delayed on high costs and technological difficulties, Oil Minister Tord Lien said. Adding that some other projects will go on as planned, Lien explained that the private sector, not the government, has to find ways to limit the negative consequences of high costs. Another reason for delays could come from the low oil prices.

Several oil and gas projects to be developed in Norway in the next two years could be delayed on high costs and technological difficulties, Oil Minister Tord Lien said. Adding that some other projects will go on as planned, Lien explained that the private sector, not the government, has to find ways to limit the negative consequences of high costs. Another reason for delays could come from the low oil prices.

On Monday, Norway’s largest financial services group DNB wrote that oil prices are likely to affect investments.

‘If the oil price remains low over a long period, and if the fall makes oil companies reassess their long- term estimate for the oil prices, it will have negative consequences for oil investments in two-three years,’ DNB wrote on Monday.

After suspending some rig work to save capital, Norwegian energy company Statoil said Tuesday it sold acreage in a key U.S. shale play for $394 million. Statoil said it sold a 6 percent stake in the Marcellus shale play to U.S. company Southwestern Energy, leaving the Norwegian company with a non-operated 23 percent interest in the region. Statoil in 2008 entered Marcellus through a joint venture with Chesapeake Energy and now says the divestment is part of its optimization strategy.”I am delighted that we have concluded this important transaction with Southwestern despite the turbulence in today’s energy markets,” John Knight, executive vice president for global business development at Statoil, said in a statement.

After suspending some rig work to save capital, Norwegian energy company Statoil said Tuesday it sold acreage in a key U.S. shale play for $394 million. Statoil said it sold a 6 percent stake in the Marcellus shale play to U.S. company Southwestern Energy, leaving the Norwegian company with a non-operated 23 percent interest in the region. Statoil in 2008 entered Marcellus through a joint venture with Chesapeake Energy and now says the divestment is part of its optimization strategy.”I am delighted that we have concluded this important transaction with Southwestern despite the turbulence in today’s energy markets,” John Knight, executive vice president for global business development at Statoil, said in a statement.

Statoil in early December suspended contracts for four rigs because of lower profitability.

The company last month suspended operations for rigs working in the Barents Sea through the end of the year, including Transocean Spitsbergen, which has a day rate of $535,000.

Analysis from Ernst & Young finds most of the investments of on the Norwegian Continental Shelf are based on oil below the $80 per mark. Some U.S. shale basins are more expensive to operate, though Marcellus remains profitable at as low as $24 per barrel.

“The transaction reduces Statoil’s non-operated holdings at an attractive price, demonstrating the value of the Marcellus assets,” Torstein Hole, Statoil senior vice president and U.S. onshore head, said.

Marcellus represents about 18 percent of total U.S. gas production and remains one of the more attractive shale basins in the United States. Production since November increased by 213 million cubic feet per day over the previous month.

Statoil shares down more than 1 percent in Tuesday trading.

The Norwegian Agency for Development Cooperation (NORAD), and the Cuban ministries of Foreign Trade and Foreign Investment (MINCEX), and the Ministry of Energy and Mines signed new agreements for bilateral cooperation in the oil sector, confirming the negotiations between the two countries started in 2011. The signed documents are part of the Oil for Development program of NORAD. With this program Norway holds meetings with Cuban authorities to share experiences on staff training, development of techniques and knowledge sharing about fuel.

The Norwegian Agency for Development Cooperation (NORAD), and the Cuban ministries of Foreign Trade and Foreign Investment (MINCEX), and the Ministry of Energy and Mines signed new agreements for bilateral cooperation in the oil sector, confirming the negotiations between the two countries started in 2011. The signed documents are part of the Oil for Development program of NORAD. With this program Norway holds meetings with Cuban authorities to share experiences on staff training, development of techniques and knowledge sharing about fuel.

The program was created in 2005 in order to train and promote the responsible management of the “black gold” in several regions of the world.

Cuban entrepreneurs as well as the Norwegian ambassador, John Petter Opdahl, said that the cooperation results are very positive. In Cuba there have been several significant evidence indicating the existence of oil and natural gas reserves.

Cuba holds oil business agreements with Canada, Venezuela, Angola, Russia, China, Vietnam; training alone with Mexico, Trinidad and Tobago, Brazil, Argentina, Norway.

(OnCuba)

Norway’s Statoil has found more gas offshore Tanzania at the Giligiliani-1 well, increasing its total for an eventual investment decision on a liquefaction plant with Britain’s BG Group, which operates neighbouring exploration blocks, it said on Tuesday. Statoil announced yesterday that it had found another 1.2 trillion cubic feet of gas in its block, taking its total volume in-place to 21 trillion cubic feet, or about 3.8 billion barrels of oil equivalents.Similarly, BG has also found about 15 trillion cubic feet of gross resources in nearby blocks.

Norway’s Statoil has found more gas offshore Tanzania at the Giligiliani-1 well, increasing its total for an eventual investment decision on a liquefaction plant with Britain’s BG Group, which operates neighbouring exploration blocks, it said on Tuesday. Statoil announced yesterday that it had found another 1.2 trillion cubic feet of gas in its block, taking its total volume in-place to 21 trillion cubic feet, or about 3.8 billion barrels of oil equivalents.Similarly, BG has also found about 15 trillion cubic feet of gross resources in nearby blocks.

This discovery has proven that the gas play extends into the western part of block 2, which opens additional prospects, Nick Maden, Senior Vice President, Statoil’s exploration activities in the Western hemisphere said in the statement.

Our success rate in Tanzania has been high and opening up a new area will be key to continuing our successful multi-well programme, he said.

The Giligiliani-1 discovery is the venture’s seventh discovery in Block 2 offshore Tanzania, preceded by the five high-impact gas discoveries at Zafarani-1, Lavani-1, Tangawizi-1, Mronge-1, Piri-1 and Lavani-2.

Statoil said the Giligiliani-1 discovery is located along the western side of Block 2 at a 2500 meter water depth and that the new gas discovery was made in Upper Cretaceous sandstones.

Statoil and its partner ExxonMobil have released few details on the project, but one of BG’s partners earlier said the volumes in place would support two 5 million tonne per annum liquefaction units, also known as LNG (liquefied natural gas) trains, with the final investment decision coming in 2016 and production beginning around 2020.

Statoil said that before an investment decision was made, it needed to ensure that it had sufficient volumes, managed the technological and subsurface risk and ensured that all legal and commercial requirements were in place for the investment.

Analysts have said they expect the project to go ahead with the partners focusing on rapidly expanding LNG markets in places such as South Korea and Japan.

Statoil operates the licence on Block 2 on behalf of Tanzania Petroleum Development Corporation (TPDC) and has a 65 per cent working interest. ExxonMobil Exploration and Production Tanzania Limited hold the remaining 35 per cent.

Statoil has been in Tanzania since 2007, when it was awarded the operatorship for Block 2.

However, mid this year, Statoil and the government entered into a dispute over profit share after the first contract between the two

parties was reviewed.

TPDC managing director, Yona Kilagane said in the original oil exploration contract, profits were to be shared equally (50/50) but changes were made in favour of the foreign company.

He said the need to change the contract came after the exploration firm discovered natural gas instead of oil as per the agreements reached in the first signed Product Sharing Agreement (PSA) in 2007.

He noted that the PSA was signed with accordance to all the country laws.

He said the original PSA had a provision stating that, in case natural gas is discovered instead of oil, parties will renegotiate basis for developing the found resources.

He said Statoil claimed ownership of 95 per cent of the profit shares leaving a mere 5 per cent for the government.

Nonetheless, Kilagane said the two parties have settled their differences and that it was mutually agreed that Statoil will get the lion’s share, 70 per cent of the profits with the government retaining 30 pct cent exclusive of corporate tax (30 pct, royalty (5 pct), TPDC participating interest (10 pct) and services levy (0.3 pct).

Early August this year, Mozambique’s state newspaper reported that Statoil pulled out at its explorations in Ruvuma basin, north of Mozambique while around the same time, TPDC confirmed that the Norwegian oil firm is actively continuing with exploration in the deep sea’s Block 2 offshore Tanzania.

(the guardian)

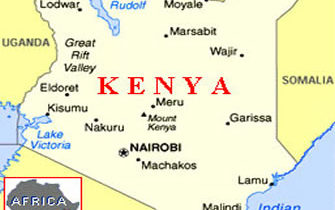

Kenya and Norway will sign an agreement on petroleum resources to help the east African country manage new oil discoveries, Norway’s new ambassador to Kenya was quoted as saying. “We are considering a long-term agreement with Kenya’s ministry of energy and petroleum on effective and socially responsible management of petroleum resources,” Victor Ronneberg said, according to a note issued by Kenya’s Presidential Strategic Communications Unit.Ronneberg presented his credentials to Kenya’s President Uhuru Kenyatta on Tuesday.

Kenya and Norway will sign an agreement on petroleum resources to help the east African country manage new oil discoveries, Norway’s new ambassador to Kenya was quoted as saying. “We are considering a long-term agreement with Kenya’s ministry of energy and petroleum on effective and socially responsible management of petroleum resources,” Victor Ronneberg said, according to a note issued by Kenya’s Presidential Strategic Communications Unit.Ronneberg presented his credentials to Kenya’s President Uhuru Kenyatta on Tuesday.

Tullow Oil and Africa Oil Corp. have discovered 600 million barrels of crude in South Loikchar basin in north western Kenya.

Commercial oil production from block 10BB and 13T in South Loikchar basin was expected to start in 2018. Kenya plans to use oil revenue to set up a sovereign fund, with the provision of healthcare one of its intended uses.

Norway’s Minister of Petroleum and Energy Tord Lien urged the European Union to continue to use natural gas and said he believes natural gas is the most effective and efficient fuel to help the EU meet its energy targets. Lien spoke at the EU-Norway Energy Conference today and argued that natural gas should be the fuel source that the EU relies on when considering its need for both energy security and energy efficiency. Norway produced 110 million cubic meters of natural gas in 2013, 98 percent of which was exported to the EU market.Lien advocated for natural gas on the basis of the well-functioning relationship between the EU and Norway, which is unlikely to cause energy instability in the same manner as the strenuous relationship between the EU and Russia, who is currently the EU’s primary energy supplier. Lien also said natural gas is the cleanest of all the fossil fuels.

Norway’s Minister of Petroleum and Energy Tord Lien urged the European Union to continue to use natural gas and said he believes natural gas is the most effective and efficient fuel to help the EU meet its energy targets. Lien spoke at the EU-Norway Energy Conference today and argued that natural gas should be the fuel source that the EU relies on when considering its need for both energy security and energy efficiency. Norway produced 110 million cubic meters of natural gas in 2013, 98 percent of which was exported to the EU market.Lien advocated for natural gas on the basis of the well-functioning relationship between the EU and Norway, which is unlikely to cause energy instability in the same manner as the strenuous relationship between the EU and Russia, who is currently the EU’s primary energy supplier. Lien also said natural gas is the cleanest of all the fossil fuels.

“We need more energy,” Lien said. “The world needs more energy. Europe and the world also need cleaner energy. Natural gas is the answer to both concerns. Replacing coal with gas in the mix is the easiest and fastest way to reduce carbon emissions.”

Lien also noted that Norway has established the necessary infrastructure to remain a stable natural gas supplier to Europe for several years.

In response to the EU’s increased focus on renewable and sustainable energy sources, Lien said he was skeptical of the reliability of those sources. He also questioned the motivations of the EU’s push towards sustainable energy, and said that the investment in renewables was at least partly caused by political measures.

“The need for stable sources of energy to combat the unstable nature of wind and solar energy is greater than ever,” Lien said. “Customers need power even when the sun is not shining and the wind is not blowing.”

Lien responded to a question regarding his level of concern towards oil drilling on the arctic shelf by repeatedly saying he supports drilling.

“I would hope to see more drilling on the shelf,” Lien said. “We have seen activity levels going in a more negative way than we expected. I would definitely like to see more drilling.”

Egypt has signed a deal with Norway’s Hoegh to supply a floating terminal needed to import liquefied natural gas (LNG), the petroleum ministry said on Monday, marking a step toward securing badly needed gas for power generation and industry. The deal will generate pretax earnings of some $40m per year for Hoegh, the firm said on Monday. A source at the Ministry of Petroleum said it would cost $1.25 to convert one million British thermal units from liquefied gas to gas. Transporting the gas from the port to the national gas network, would cost $1.The contract for the Floating Storage and Regasification Unit will last for five years, the ministry said in a statement. It added that the terminal would be moored off of the Red Sea port of Ain Sokhna from 1 September, and that the platform has a storage capacity of 170,000 cubic metres. The final testing was conducted in South Korea.

Egypt has signed a deal with Norway’s Hoegh to supply a floating terminal needed to import liquefied natural gas (LNG), the petroleum ministry said on Monday, marking a step toward securing badly needed gas for power generation and industry. The deal will generate pretax earnings of some $40m per year for Hoegh, the firm said on Monday. A source at the Ministry of Petroleum said it would cost $1.25 to convert one million British thermal units from liquefied gas to gas. Transporting the gas from the port to the national gas network, would cost $1.The contract for the Floating Storage and Regasification Unit will last for five years, the ministry said in a statement. It added that the terminal would be moored off of the Red Sea port of Ain Sokhna from 1 September, and that the platform has a storage capacity of 170,000 cubic metres. The final testing was conducted in South Korea.

Egypt, which cannot import LNG without the terminal, began soliciting proposals for the project about 18 months ago.

(daily news egypt)

Norges Bank Investment Management bought an office and retail complex opposite Paris’s Le Madeleine church for 425.6 million euros ($570 million) from a fund managed by Blackrock Inc. (BLK) The 31,500 square-meter (339,000 square-foot) Le Madeleine building has been completely refurbished since it was acquired by Blackrock Europe Property Fund III in 2009, the world’s largest money manager said in a statement today. Tenants include Chanel, Visa and C&A.

Norges Bank Investment Management bought an office and retail complex opposite Paris’s Le Madeleine church for 425.6 million euros ($570 million) from a fund managed by Blackrock Inc. (BLK) The 31,500 square-meter (339,000 square-foot) Le Madeleine building has been completely refurbished since it was acquired by Blackrock Europe Property Fund III in 2009, the world’s largest money manager said in a statement today. Tenants include Chanel, Visa and C&A.

“The acquisition was made when there was little liquidity in the market, but we feel the building is now transformed,” Jean-Philippe Olgiati, a director at BlackRock Real Estate, said in the statement. The company is “assessing future opportunities to deploy capital in France and generate returns for our clients.”

Norway’s $890 billion sovereign wealth fund, the world’s biggest, formed a real estate group last month that will invest almost $10 billion annually over the next three years. The fund already owns properties on London’s Regent Street, Times Square in New York and the avenue des Champs-Elysees in Paris.

(bloomberg)

Energy Minister Michael Fallon is chairing a UK Norway manufacturers’ roundtable today to boost competitiveness in securing more business in North Sea projects. At the roundtable meeting, representatives from both the UK and Norwegian manufacturing sector will examine opportunities to work together on large offshore projects which are currently being lost to the Far East.A number of significant projects are expected to be approved in the North Sea over the next couple of years, and it is hoped that the new model will enable British businesses to support a dynamic supply chain that sustains high-quality jobs in the UK and Norway.

Energy Minister Michael Fallon is chairing a UK Norway manufacturers’ roundtable today to boost competitiveness in securing more business in North Sea projects. At the roundtable meeting, representatives from both the UK and Norwegian manufacturing sector will examine opportunities to work together on large offshore projects which are currently being lost to the Far East.A number of significant projects are expected to be approved in the North Sea over the next couple of years, and it is hoped that the new model will enable British businesses to support a dynamic supply chain that sustains high-quality jobs in the UK and Norway.

The Minister will attend bilateral meetings with the Norwegian Energy Minister, Mr Tord Lien, and the Norwegian Deputy Trade Minister Dilek Ayhan. He will also meet leading energy companies at the Oslo Energy Forum, the annual oil and gas industrial leaders gathering. As well as promoting the investment opportunities available in UK energy, this meeting will help to reaffirm the strategic importance of the UK Norway energy relationship.

Norway plays a significant role in the UK’s energy mix, through gas and oil imports and investment in UK renewables. In 2012, Norway was the source of 55% of UK gas imports and 46% of oil imports, representing over one-third of our total primary energy demand.

Energy Minister Michael Fallon said:

“Britain has a long history of expertise in oil and gas services. When new opportunities for exploration and development are emerging, it is crucial that we work together with Norway to ensure that we secure contracts in the North Sea, to support hundreds of jobs and boost growth here, rather than in the Far East.”

In the UK, the Government has already developed a set of concrete actions in the Oil and Gas Industrial Strategy published last year. These actions include skills development, improving access to finance, offshore safety and decommissioning.

(wired gov)

Norway has announced it is to make a major investment in renewable energy, with the European country opening up its sovereign wealth fund to the sector. The news is likely to spark plenty of debate about what the future holds for the renewable energy industry in Norway and the development was immediately warmly welcomed by the World Wildlife Fund (WWF). Nina Jensen, chief executive of the WWF in Norway, stated that the body is “thrilled” Norway has decided to take the lead on renewable energy by making a significant investment in the industry.She said: “If done at scale, this will have global impact and redefine how we use money consistent with commitments to limit climate change.

Norway has announced it is to make a major investment in renewable energy, with the European country opening up its sovereign wealth fund to the sector. The news is likely to spark plenty of debate about what the future holds for the renewable energy industry in Norway and the development was immediately warmly welcomed by the World Wildlife Fund (WWF). Nina Jensen, chief executive of the WWF in Norway, stated that the body is “thrilled” Norway has decided to take the lead on renewable energy by making a significant investment in the industry.She said: “If done at scale, this will have global impact and redefine how we use money consistent with commitments to limit climate change.

“We have long advocated that the fund invest up to five per cent in infrastructure for renewable energy. This will require a change in the guidelines for the fund, similar to the mandate to investing in property that was granted in 2010.”

It was also pointed out by Ms Jensen that the pension fund is the largest state investor in the world, while a solid renewable energy mandate will “send a tremendously powerful signal and set the standard for other international investors”.

Prime minister of Norway Erna Solberg confirmed that the government is set to create a renewable energy investment mandate that will have the same management requirements as other investments in the fund.

WWF financial analyst Lars Erik Mangset stated that the Norwegian government will need to make sure the mandate allows for direct investment in renewable infrastructure where a large scale of capital is “urgently needed”. He said: “We will be looking to see if the government award a mandate to allow up to five per cent of the fund to be invested into renewable energy infrastructure and exactly how they extended the fund to invest in real estate.”

The WWF is campaigning for financial institutions – such as major sovereign wealth funds, pension funds and multilateral development banks – to significantly increase funding of renewable energy. The scheme, called Seize Your Power and named Det Skjer in Norway – also urges bodies to cut funding to fossil fuels as a key means of tackling climate change.

As well as Norway, Germany is among the other European nations investing in renewables.

(boilerjuice)

A North Sea platform was shut and half its workers evacuated after an oil and gas leak. The incident happened on Saturday afternoon on the Statfjord A platform, one of three platforms in the large Statfjord oil field on the UK-Norway border. Following the discovery of the leak, 168 members of staff were evacuated to platforms B and C by helicopter.Kjetil Visnes, a spokesman for Statoil – which runs the oil field, said: “The leak was reported at about 4.40pm. It had occurred some 10 minutes before.”

A North Sea platform was shut and half its workers evacuated after an oil and gas leak. The incident happened on Saturday afternoon on the Statfjord A platform, one of three platforms in the large Statfjord oil field on the UK-Norway border. Following the discovery of the leak, 168 members of staff were evacuated to platforms B and C by helicopter.Kjetil Visnes, a spokesman for Statoil – which runs the oil field, said: “The leak was reported at about 4.40pm. It had occurred some 10 minutes before.”

There were no reports of injuries, he said, and the incident was over by 6.20pm.

It is not clear when output will resume. The spokesman declined to say how much oil and gas the platform was producing at the time.

It is the second leak at the field this year. In October, 345 cubic metres of chemicals and drilling fluids leaked from a well connected to the Statfjord B platform.

Statoil said it was implementing new safety measures after it was reported to Norwegian police by Bellona, the environmental group, over the incident.

The Statfjord field, one of the largest in the North Sea, lies 110 miles from the Norwegian coast.

The Statfjord field produced 129,000 barrels per day in December, or four million barrels for the month, and was expected to produce the same amount in January, according to loading schedules compiled by Reuters.

The oil field is due to be decommissioned in 2020.

(telegraph)

A conference on ‘Oil and Gas Cyber Security’ will be held from 3 to 4 June 2014 in Oslo, Norway. By 2018 the oil and gas industry will be spending up to EUR 1.37 billion on cyber security. The increased demand to protect a multi-billion dollar global industry is being spurred on by the ever growing cyber threat across the globe.

A conference on ‘Oil and Gas Cyber Security’ will be held from 3 to 4 June 2014 in Oslo, Norway. By 2018 the oil and gas industry will be spending up to EUR 1.37 billion on cyber security. The increased demand to protect a multi-billion dollar global industry is being spurred on by the ever growing cyber threat across the globe.

The event will provide a platform to learn about leading industry case studies from oil and gas operators as well as understanding what their operational needs and requirements are.

Key areas of discussion will centre on new technologies to counter threats and information management in the digital age.(NORWAY NEWS)

The Norwegian Petroleum Directorate (NPD) has issued an update on its analysis of recoverable oil from Norway’s various offshore fields and discoveries. NPD’s goal in 2005 was to achieve growth in oil reserves of 5 BBbl over 10 years. The actual result is somewhat below that figure, although the target would have been achieved if Statoil’s development plan for Johan Sverdrup in the North Sea had been submitted before the end of 2014.“There has been substantial resource growth in many fields,” said Kirsti Veggeland, assistant director general for shelf analysis. “The most important reasons for this are more wells, extended field lifetimes and improved knowledge.”

The Norwegian Petroleum Directorate (NPD) has issued an update on its analysis of recoverable oil from Norway’s various offshore fields and discoveries. NPD’s goal in 2005 was to achieve growth in oil reserves of 5 BBbl over 10 years. The actual result is somewhat below that figure, although the target would have been achieved if Statoil’s development plan for Johan Sverdrup in the North Sea had been submitted before the end of 2014.“There has been substantial resource growth in many fields,” said Kirsti Veggeland, assistant director general for shelf analysis. “The most important reasons for this are more wells, extended field lifetimes and improved knowledge.”

In addition, NPD reviewed 62 discoveries for which development decisions had not been taken in 2005. Since then, 28 have been developed and their oil reserves, due to a combination of new information, improved reservoir understanding and optimization of development solutions and drainage strategies.

Discoveries made after 2004 also led to development decisions for 13 new fields, and these have contributed 80 MMcm to reserves growth, with Edvard Grieg, Ivar Aasen, and Knarr, accounting for over 75% of that figure.

NPD had hoped that improved recovery measures would lead to stronger growth in oil volumes, Veggeland added. “However, many new opportunities to improve recovery have been identified, and the potential is greater in 2015 than it was 10 years ago.”

(offshore-mag)

The Norwegian Petroleum Directorate (NPD) has issued an update on its analysis of recoverable oil from Norway’s various offshore fields and discoveries. NPD’s goal in 2005 was to achieve growth in oil reserves of 5 BBbl over 10 years. The actual result is somewhat below that figure, although the target would have been achieved if Statoil’s development plan for Johan Sverdrup in the North Sea had been submitted before the end of 2014.“There has been substantial resource growth in many fields,” said Kirsti Veggeland, assistant director general for shelf analysis. “The most important reasons for this are more wells, extended field lifetimes and improved knowledge.”

The Norwegian Petroleum Directorate (NPD) has issued an update on its analysis of recoverable oil from Norway’s various offshore fields and discoveries. NPD’s goal in 2005 was to achieve growth in oil reserves of 5 BBbl over 10 years. The actual result is somewhat below that figure, although the target would have been achieved if Statoil’s development plan for Johan Sverdrup in the North Sea had been submitted before the end of 2014.“There has been substantial resource growth in many fields,” said Kirsti Veggeland, assistant director general for shelf analysis. “The most important reasons for this are more wells, extended field lifetimes and improved knowledge.”

In addition, NPD reviewed 62 discoveries for which development decisions had not been taken in 2005. Since then, 28 have been developed and their oil reserves, due to a combination of new information, improved reservoir understanding and optimization of development solutions and drainage strategies.

Discoveries made after 2004 also led to development decisions for 13 new fields, and these have contributed 80 MMcm to reserves growth, with Edvard Grieg, Ivar Aasen, and Knarr, accounting for over 75% of that figure.

NPD had hoped that improved recovery measures would lead to stronger growth in oil volumes, Veggeland added. “However, many new opportunities to improve recovery have been identified, and the potential is greater in 2015 than it was 10 years ago.”

(offshore-mag)